transfer taxes refinance georgia

10 Best Home Refinance Compared Reviewed. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded.

4 Great Ways For Expats To Manage And Transfer Money Forbes Advisor

Since you will not be required to pay the transfer taxes on a refinance and you should be able to save money with the above-described cost saving tips you will find that the overall expense for.

. LendingTree Makes Your Mortgage Refinance Search Quick and Easy. Comparing lenders has never been easier. Current through Rules and Regulations filed through July 7 2022.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The tax for recording the note is at the rate of 150 for each 50000 or fractional part of the face amount of the note. All recorded liens andor security interests against the previous owner must be released in the spaces provided on the title.

Georgia liability insurance reported by your Insurance Company. Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

13th Sep 2010 0328 am. In a refinance transaction where property is not. The maximum amount of recording tax on any single note is 25000.

Apply Get Pre Approved In 24hrs. Title insurance is a closing cost for purchase and refinances mortgages. Toll Free 8884048111 Purchasing a home in Georgia Georgia refinance Georgia closing attorney Intangible Tax 300 per thousand of the sales price Georgia Transfer Tax 100 per.

Refinance Today Save Money By Lowering Your Rates. State laws usually describe transfer tax as a set. Rule 560-11-8-05 - Refinancing.

Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps. Your Loan Should Too. 07th Sep 2010 0515 pm.

A property selling for. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2.

1 Intangible recording tax is not required to be paid on that part of the face. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. ACH Credit Electronic Funds Transfer Information Georgia Department of Revenue ACH Credit Electronic Funds Transfer Information The GA Department of Revenue uses CCD with TXP.

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Intangible Tax 300 per thousand. Ad Compare top lenders in 1 place with LendingTree.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Subject 560-11-8 INTANGIBLE RECORDING TAX Rule 560-11-8-01 Purpose of Regulations. On any amount above 400000 you would have to pay the full 2.

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. These regulations have been adopted by the Commissioner pursuant to OCGA. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing.

If the holder of an instrument. Seller Transfer Tax Calculator for State of Georgia. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000.

The Home Buying Road Map How To Buy A House Home Buying Process Home Buying First Time Home Buyers

4 Great Ways For Expats To Manage And Transfer Money Forbes Advisor

Transferring Property Ownership Pros Cons Other Options

United States Personal Current Transfer Receipts Government Social Benefits To Persons Unemployment Insurance 2022 Data 2023 Forecast 1947 2021 Historical

Transfer Tax Calculator 2022 For All 50 States

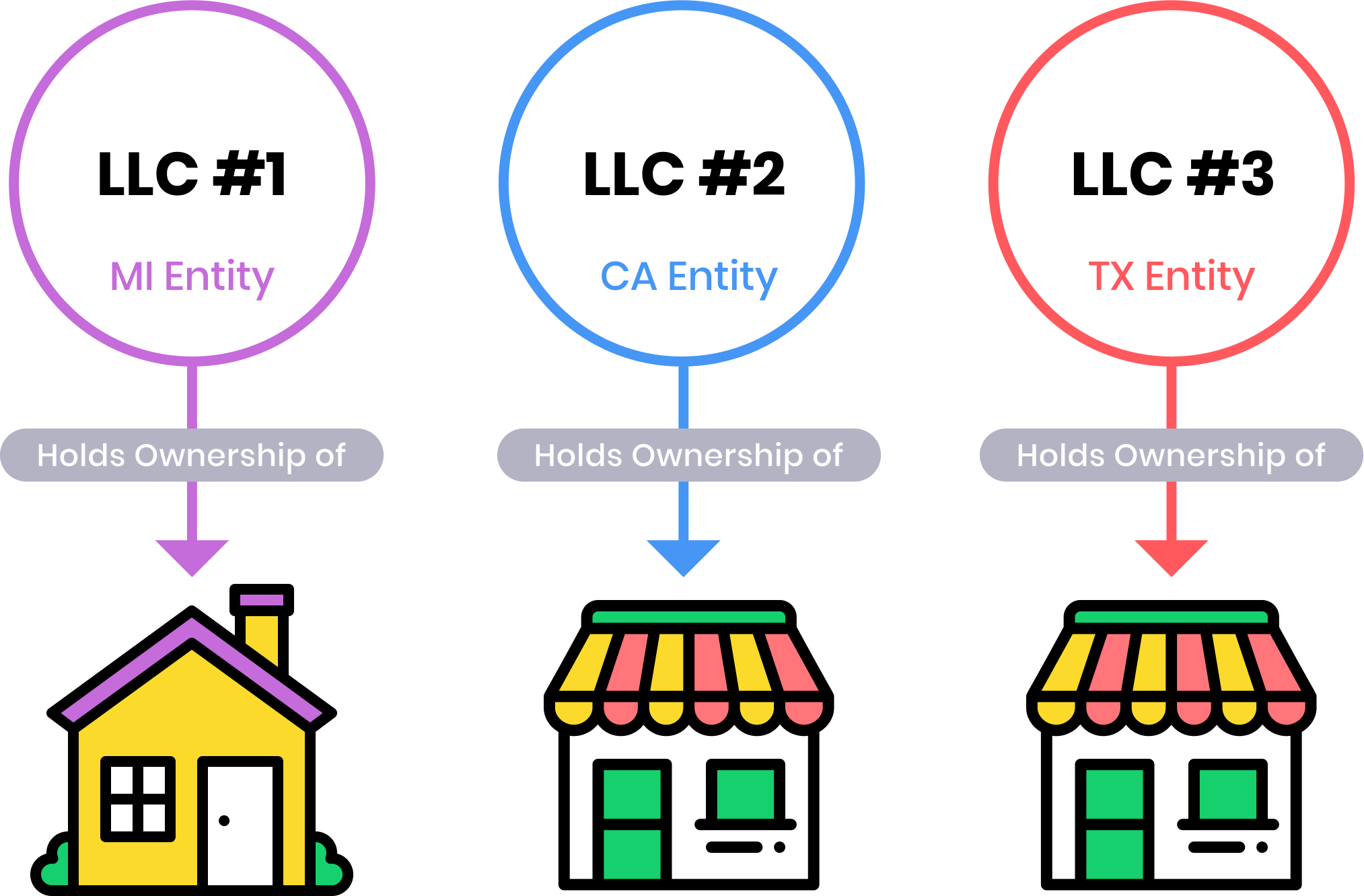

Should I Transfer The Title On My Rental Property To An Llc

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

Should I Transfer The Title On My Rental Property To An Llc

United States Federal Government Current Transfer Payments Government Social Benefits 2022 Data 2023 Forecast 1929 2021 Historical

What Is A Homestead Exemption And How Does It Work Lendingtree

Should I Sign A Quitclaim Deed During Or After Divorce

How A Transfer On Death Deed Affects Medicaid Benefits Accessible Law

Can A Power Of Attorney Transfer Money To Themselves Smartasset

How A Transfer On Death Deed Affects Medicaid Benefits Accessible Law

6 Mistakes To Avoid When Refinancing Your Home Georgia S Own